Newsletter #24: "It's Not The Glove's Fault!"

Jan 22, 2026

“If you take risks and face your fate with dignity, there is nothing you can do that makes you small; if you don’t take risks, there is nothing you can do that makes you grand, nothing.”

― Nassim Nicholas Taleb, Antifragile: Things That Gain From Disorder

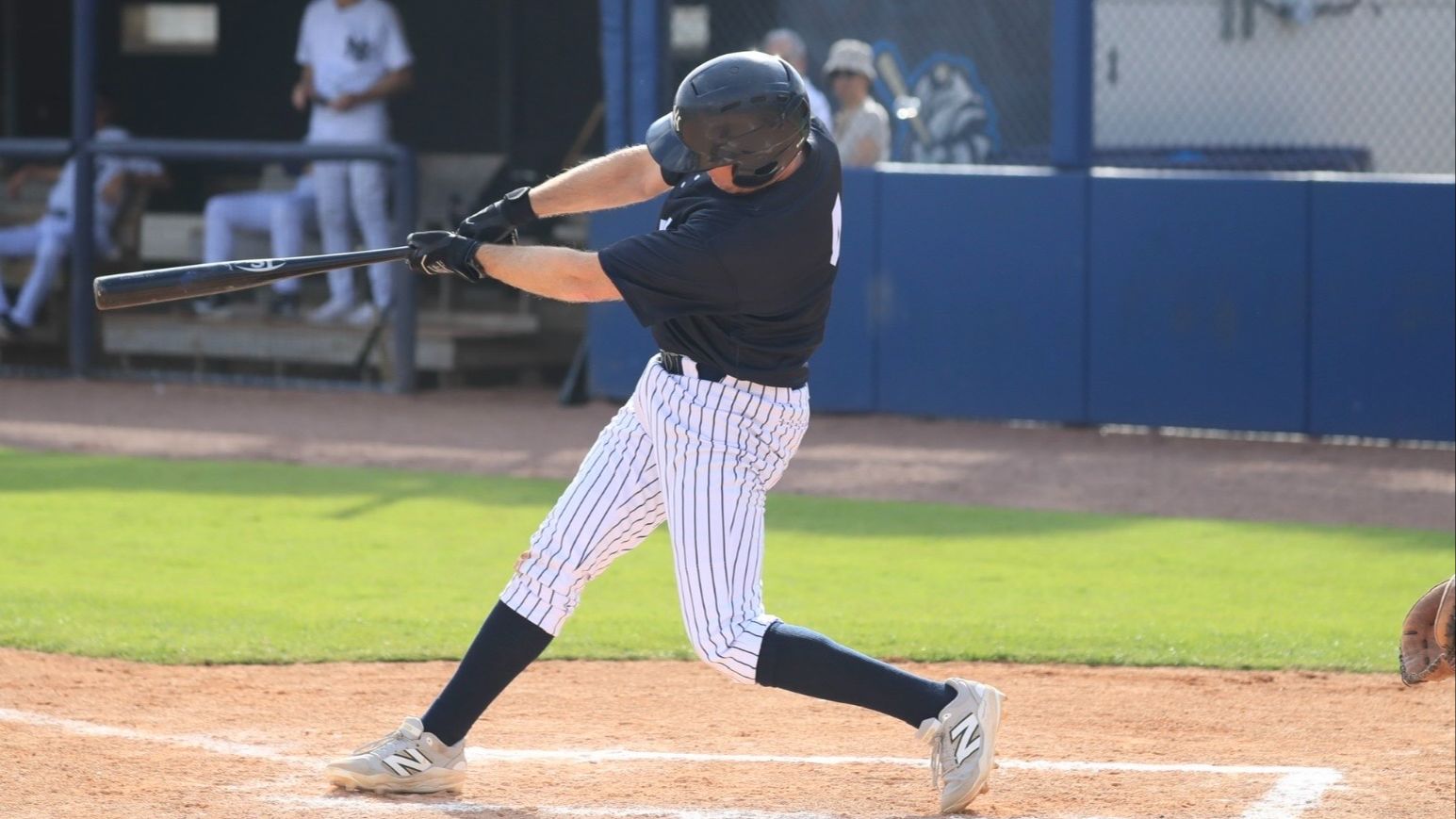

I recently spent a week in Tampa, participating in the New York Yankees Fantasy Baseball Camp. I had played baseball through college, but had not really played competitive baseball in 28 years - so I was equal parts excited and petrified as I boarded the plane for Florida. My list of goals for the camp, in order of importance, were: 1. Don’t get injured; 2. Have fun; and 3. Try to not embarrass myself on the field- particularly in the game we would be playing against former major leaguers who I have followed closely for years.

I am thankful to say that I absolutely achieved the first two goals: despite some minor aches and pains, I escaped injury; and I absolutely had a wonderful time. The third one was more of a mixed bag: I had some glimmers of success at the plate, and several seriously atrocious plays on defense in the infield. I cringed when one of our coaches (former Major League outfielder Clay Bellinger) yelled out “don’t look at the glove! It’s not the glove’s fault!” after I made an error at shortstop. But it was also deeply satisfying to have our other coach (former Major League pitcher Kyle Farnsworth) say to my kids “your dad did awesome: he could work on his fielding a little bit but he can swing it real good.”

As I return to the life of a common person now that I am back from my week with the Yankees, I have reflected on the many lessons from the baseball field that apply to my job as a venture investor:

First, preparation is key: Louis Pasteur once said “fortune favors the prepared mind.” This is completely true in baseball. Why did I think that 28 years of rust would magically disappear when I was in the field? I should have taken thousands of ground balls ahead of Tampa if I expected to field like I used to be able to- particularly because I am no longer in my teens or 20s. Likewise, venture investing is in large part pattern recognition- and recognizing patterns is far easier with repetition and larger data sets.

Second, the importance of maintaining humility: Ted Williams once said, “baseball is the only field of endeavor where a man can succeed three times out of ten and be considered a good performer.” I would argue that venture investing is another such field. In both cases, it is crucial to maintain humility and to maintain constant focus on the process in order to get incrementally better. My college coach, Randy Town, once said, “the day you feel like you have it figured out is the day your next slump begins.” That is equally true for baseball as it is for venture investing.

Third, the need to remain nimble: this is true in baseball in many ways: A. Of course you must be nimble in fielding your position and running the bases. B. You must also be nimble as a hitter in adjusting to the pitcher, who is likewise constantly adjusting to the hitter’s tendencies. C. I had to be nimble in re-learning proper technique, because the way they teach hitting, fielding and pitching has changed so much over the past 30 years. Likewise, you must be nimble as a venture investor: in assessing businesses, in assessing the expected lifespan of a thematic trend, in assessing the ebbs and flows of funds at a macro level.

Fourth, critically assessing your strengths and weaknesses: in baseball, this manifests itself in many ways both at bat and in the field. For instance, when at bat, a hitter must be able to tell which ball / strike counts, which quadrants of the strike zone, and which pitch types maximize the hitter’s likelihood of success – and then exploit those opportunities. In venture investing, one constantly comes across potential portfolio companies which are outside one’s core investment thesis. When those companies look attractive, it is difficult to not “take a swing” at them- but in order to be successful, you must lay off them to maximize the chance of success with other companies that are more perfect fits.

Fifth, overcoming the fear of looking stupid: in baseball, you are guaranteed to look stupid at times. I went into this camp as a 50 year old knowing for a fact that I was going to look stupid. And while the risk-averse, easy way out would have been to not go to Tampa at all, that would have been a mistake because I would have missed out on an absolutely incredible experience. Likewise, every venture capital firm has had investments that in retrospect look crazy. But had those firms not overcome the fear of looking stupid, they would also have missed out on the hugely successful investments in their portfolio. In both cases, the upside hugely outweighs the downside if done correctly.

Lastly, persistence despite fear of failure leads to major improvements in performance: Nassim Taleb calls this “antifragility”- or getting stronger when exposed to stress. He said, “we can almost always detect antifragility (and fragility) using a simple test of asymmetry: anything that has more upside than downside from random events (or certain shocks) is antifragile; the reverse is fragile.” Both baseball and venture capital investing are antifragile endeavors.

Hearkening back to Taleb’s quote at the beginning of this article, taking a calculated risk and facing my fate with dignity allowed me to come away from the Yankees fantasy camp not only intact, but thrilled. We expect the same outcome will be achieved by Ocampo Capital in 2026 and beyond, after another year of taking calculated risks.

Ocampo Capital is a trajectory amplifier: It advises, supports, and invests in consumer companies, aiming to help them achieve their aspirations.

We hate SPAM. We will never sell your information, for any reason.